Cameo supports several services and companies – payment processors – which can take payments for you in forms, either recurrent or one-off.

This article summarises how these relate to Cameo’s payment methods and bank accounts. It lists the providers available, with details about each.

Contents

Payment methods

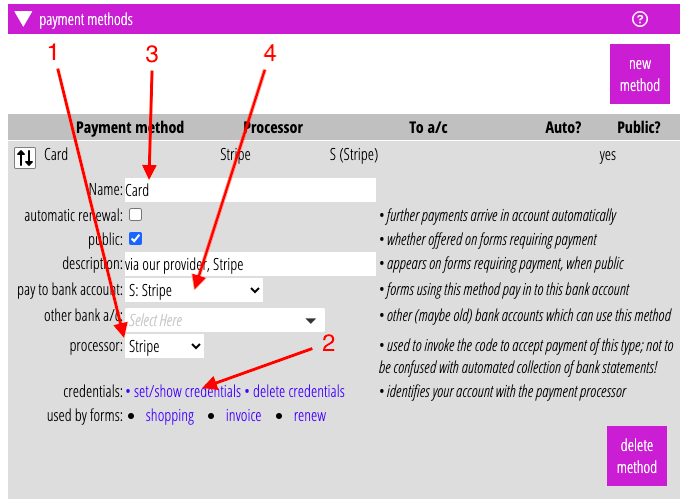

Define payment methods you want to offer, in organisation settings → payment methods (Fig 1). Each form can then offer a different combination of methods from among those you define: they don’t all have to offer all of them. For example, you may choose to only offer event tickets by credit card (and in any case, you wouldn’t normally offer direct debits for this purpose).

For each, choose the processor that provides the service for you (Fig 1: 1). Most of these providers then need you to supply credentials so your payments are directed correctly to your account with them (Fig 1: 2). Click the link alongside the provider to supply these: the box that pops up explains where to look for these in the provider’s control panel. Occasionally you may have more than one payment method using the same provider but different accounts (and therefore different credentials). For example, you might want to keep invoice payments separate from ticket purchases. The respective forms would both offer card payments, but they would not be linked to the same account.

Give names for payment methods that the customer will understand (Fig 1: 3). So, credit/debit card, not Stripe (who they are unlikely to have heard of; you might include processed by our provider, Stripe in the additional description).

If you leave the provider as none, there is no step to take payment in forms when someone chooses that method (you might use that for cheques, for example, where all you need to do is display the payment details they need on the final confirmation step).

Bank accounts

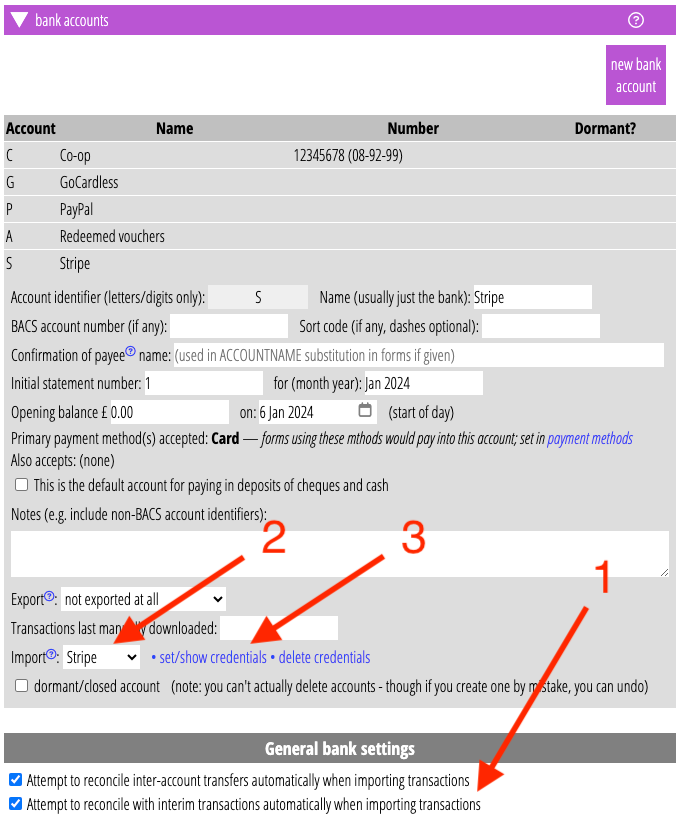

Each payment method links to a “bank” account (Fig 1: 4). For Cameo, your account with a payment processor is a bank account. You may not initially think of them as a bank, but doing so simplifies how you handle them considerably. For example, it is hard to attribute an aggregated payment net of fees to a particular membership if all you work from is the payout to your current account. Treating the provider as a bank lets you attribute the gross payment to the member, attribute fees to bank charges, and net, aggregate pay-outs as inter-account transfers. Set up bank accounts in organisation settings → bank accounts (Fig 2).

Different payment methods often use the same bank account. Your Stripe account, for example, would service both card and Apple Pay payments. Your bank current account would service both payments by transfer and standing orders. Some of these accounts can automatically import their transactions (Fig 2: 1, Fig 2: 2), shown in accounting info → bank statements, and offered for reconciliation in accounting tasks → reconciliation.

To do this, also supply credentials from the provider in organisation settings → bank accounts (Fig 2: 3). These are separate from the payment method credentials: they serve quite different purposes. Payment method credentials let you take payments, while bank statement credentials let you obtain existing transactions. In some cases, such as GoCardless, they look similar (but they don’t have the same privileges); in others, such as PayPal, they look quite different.

If you take gift vouchers as a payment method, you still need to connect this to a “bank” account. All incoming payments have to go somewhere. Create an account for the purpose, such as redeemed vouchers. A voucher would be purchased using some conventional payment method. It then becomes a liability for accounting purposes, balanced against the real income. When redeemed, the entry in the nominal bank account cancels out the liability.

List of payment providers

Automated (repeat) payments

| Provider | Service provided | Fees (for guidance only: check with provider that these are still current) | Transaction imports | Notes |

| GoCardless | Direct Debits | 1.175% inc VAT per transaction | automatic | |

| (clearing) banks | Standing Order | free (some banks may charge for deposits per transaction on business accounts) | automatic Open Banking feeds via either GoCardless Bank Account Data or Xero or manually import file (in accounting tasks → import statements) | GoCardless Bank Account Data is different product from their direct debit processing; they currently can’t handle CAF Bank or Co-operative domestic accounts. It’s free for a small number of accounts. Xero feeds can’t get data from CAF Bank automatically. Xero is only useful if you already use them for accounts |

Manual (one-off) payments

| Provider | Service provided | Fees (for guidance only: check with provider that these are still current) | Transaction imports | Notes |

| Stripe | Card payments in Cameo forms | 1.5%+20p per transaction | automatic | All common cards accepted, including Visa, Mastercard and AmEx. |

| StripeCheckout | Card payments initiated from Cameo form but payment taken on Stripe’s website | 1.5%+20p per transaction | automatic | Rather than embedding a form to enter card details, Stripe provides the form on their website, (rather like PayPal). |

| PayPal | Card payments or PayPal account | 3.4%+30p per transaction (less for charities) | automatic | PayPal is well-known, but erratic. Their link for people without an account to pay by card is hard to find, and they sometimes even omit it. |

| Apple Pay / Google Pay | Card payments (processed by Stripe) | 1.5%+20p per transaction | automatic | Lets people pay using fingerprint or face detection |

| Zettle | Card payments in person via card reader machine | 1.75%+20p per transaction | automatic | Zettle is now owned by PayPal |

| (clearing) banks | Transfer via Faster payment / BACS | usually free (some banks may charge for deposits per transaction on business accounts) | automatic or file import (see Standing Order above) | |

| Voucher | free to redeem; purchase at rate of method used | n/a | ||

| Cheque | usually free (some banks may charge for depositing cheques on business accounts) | record cheques and deposits in accounting tasks → deposits match with bank statements via automatic Open Banking feed or file import (see Standing Order above) | ||

| Cash | usually free (some banks may charge for depositing cash on business accounts) | ditto |