Interim transactions now include payment method name and payee account details (such as the last four digits of the credit card number they used) in the transaction description.

When an interim transaction is reconciled with a real transaction (whether manually or automatically), its description is now copied to the real transaction, so this information is not lost.

Contents

Background

An interim transaction is added to the bank statement associated with the payment method someone uses to pay in a form. This is because the form already knows how to attribute the transaction (including:

- which related member, invoice or event booking, and

- usually which book-keeping account code as well)

that would otherwise have to come from manual reconciliation.

When the bank provides the real transaction, it is matched with the interim transaction (often automatically). This avoids the need for further reconciliation.

Transaction description

Previously the payment reference and other information was stored with the interim transaction, but not necessarily carried over by the bank.

So, to avoid potentially useful information being lost, when an interim transaction is matched to a real transaction (automatically or manually), the interim transaction description is now copied to the real transaction. This is in addition to linking the interim attribution to the real transaction as before.

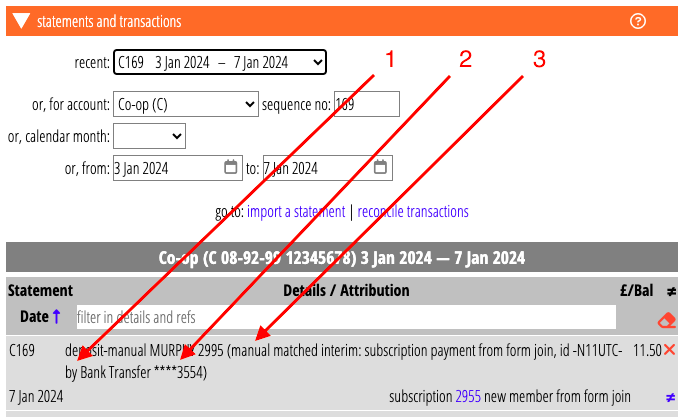

This real transaction also records whether the matching was done automatically or manually (Fig 1: 3).

These are displayed wherever transactions are displayed, for example in bank statements.

Originating account

Making these details more useful, interim transactions now also include:

- the payment method name (Fig 1: 1), and

- the payee account details supplied by the payment provider when they pay (Fig 1: 2).

For example:

- Stripe supplies the last four digits of the account number,

- when using a gift voucher, this is the code of the voucher they redeemed,

- for a bank transfer, it is the last four digits of their account number which they supplied during payment,

- and so on.