More information is now available within Cameo when using GoCardless as direct debits service provider (visible to Cameo users with financial privileges).

Contents

New controls

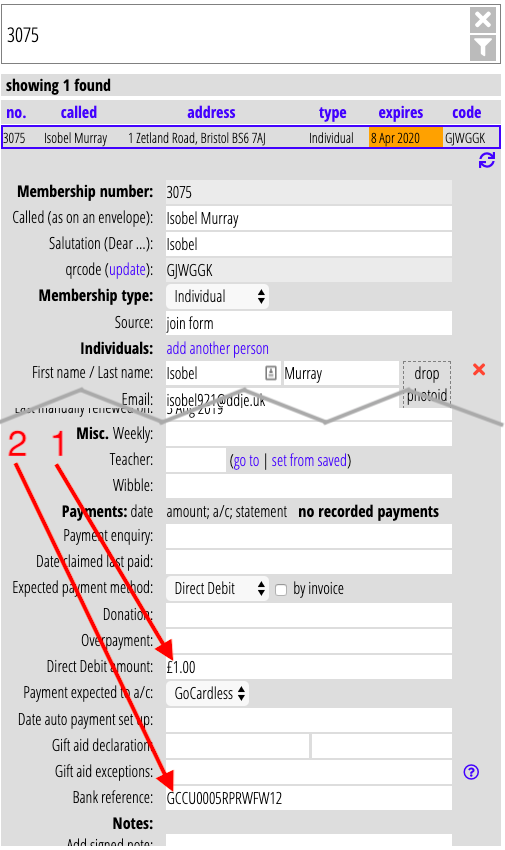

- Membership records have a new field, Direct Debit amount, which records the amount of the regular payment by Direct Debit (Fig 1: 1). This is set by the join and renew forms and also if subscription rates are increased. The field can also be updated by reference to GoCardless records (see below) and also manually, if necessary, like any other field. Because of additional donations and the like, this amount isn’t necessarily the same as the subscription plus donation.

- GoCardless’ Customer Identifier is automatically stored in the membership Bank Reference field when signing up to a direct debit (Fig 1: 2) through the join or renew forms. These are prefixed with

GC...to make them recognisable as such; for example:GCCU123ABC456.

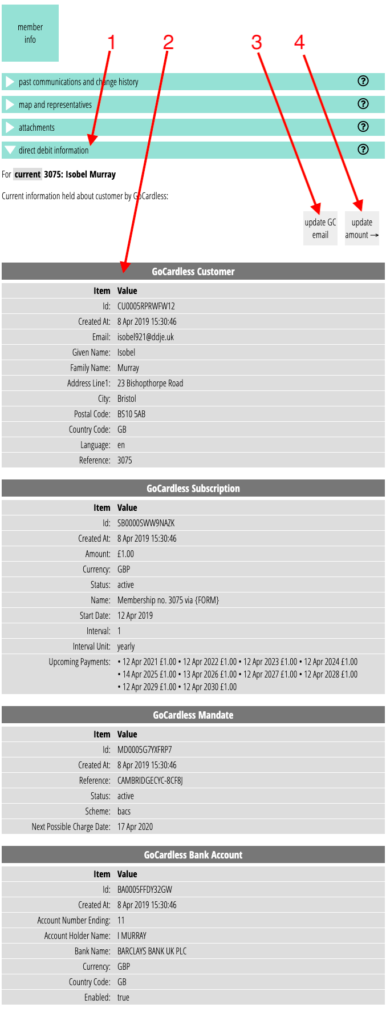

- A new section direct debit information (Fig 2: 1) on the Membership Info menu retrieves GoCardless records for the selected membership (Fig 2: 2; using the Customer Identifier in its Bank Reference field. This presents much the same information as GoCardless’ dashboard (but only for live mandates and subscriptions).

- The direct debit information section also has two buttons:

- update GC email (Fig 2: 3), which updates GoCardless’ record of the customer’s email address, and

- update amount (Fig 2: 4), which replaces the membership record’s direct debit amount field with that held by GoCardless. (It could get out of step if updated manually in the GoCardless dashboard, for example).

- A new substitution

{show: direct debit amount}includes the value in the direct debit amount field during template merging. - Automatic transaction feeds for GoCardless now include the customer number in the transaction details for bank statements and reconciliation (just from now on, this isn’t retrospective). As these already make use of the Bank Reference field for matching with the payee, this matching is made more reliable.

Email addresses

When a customer signs up for a direct debit with GoCardless, they may use a different email address. This is completely legitimate: they may do so for privacy reasons, or because someone else’s bank account is being used (hopefully with their permission).

However, that does mean it can be difficult to match up GoCardless records with Cameo records. Storing the Customer Identifier in Cameo makes this easier and the update GC email button makes keeping the two in step easier. However, this should generally only be done when the two email addresses matched before a new one was applied, or where it is obvious there is a mistake in GoCardless records.

Updates in GoCardless

Cameo has no easy way to know if updates are made manually in the GoCardless dashboard, so may have to be updated separately. This is particularly true of the direct debit amount.

Generally, however, the customer number won’t change. If a new mandate is created or bank account changes, this will usually be applied to the same customer, so you will see the updated information in the Direct Debit information section (and if for a different amount, you’d have to update Cameo). Usually, mandates will be recreated automatically by the bank switch service if someone changes their bank account.

However, if someone has to create a new mandate manually and they may end up with a new GoCardless account. In that case, it would be necessary to manually apply the customer identifier to the Cameo record to re-link the two. The customer identifier is shown at the top of GoCardless’ dashboard customer page, and should be prefixed with GC when placed in the _bank reference_ field.