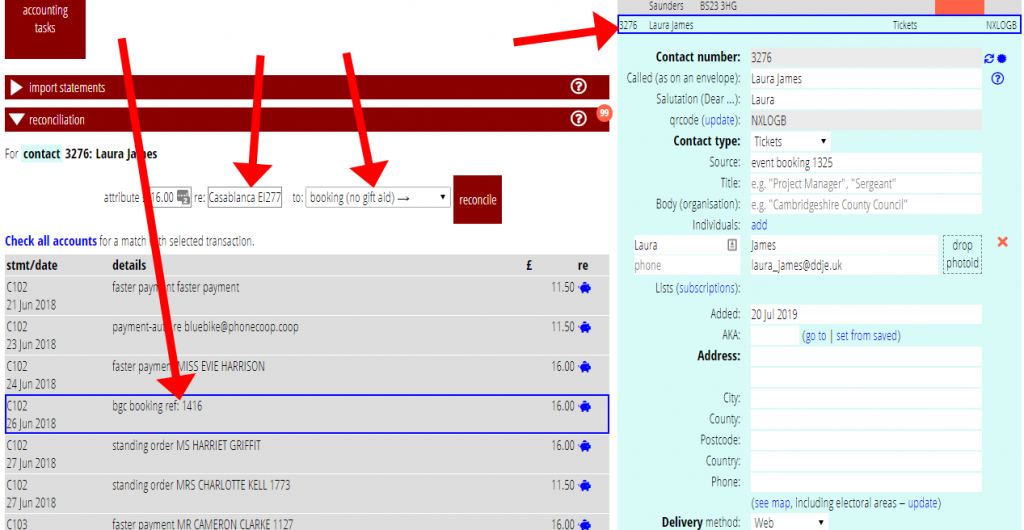

When reconciling bank statement transactions in Accounting Tasks, it is now possible to attribute a booking made through Cameo’s event booking form, or manually in the Reservations, Bookings and Attendance section, to a transaction. Because bookings are (almost always) linked to a membership record, reconciliation links the transaction to the membership record, as well as recording the event for which it was made.

The information that this was a booking attributed to a particular member is set in the reconciliation type menu, just as it would be if it were a a subscription. If you can collect Gift Aid on ticket sales, there is also a second option to include that.

If the transaction is recognised as a booking (the transaction description from the bank – which very often originates from the reference description provided to the booking form definition – contains an identifiable booking reference number), the booking will be looked up. If found, it will:

- set the default attribution to booking (no gift aid),

- select the purchaser (if the payment was not to their usual account, you may need to select Check all accounts to see them), and

- fill in the comment field with the event name and event instance number.

When you press the Reconcile button, all those details (including the membership number) are retained with the attribution.

If the booking came from a cheque or cash deposit that you recorded, this should be located, but you will need to look up the booking reference manually.

Contents

How booking reconciliations are used

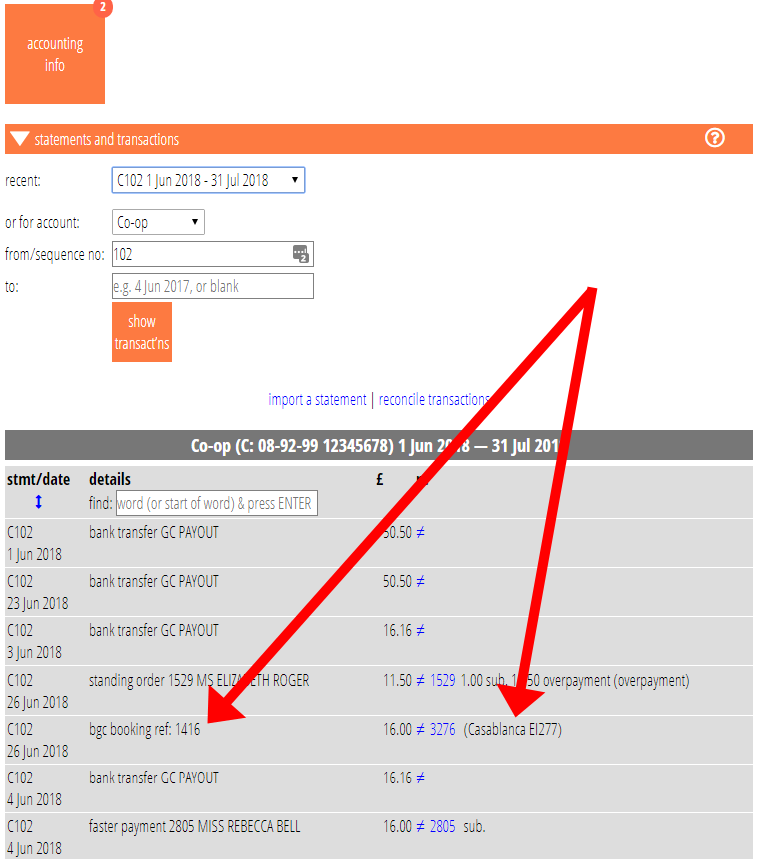

Once a transaction has been attributed to a booking, it will, of course, show up in the statement in Accounting Info:

It will also appear in the statement downloads available in various formats beneath the statement, and when details are exported as part of accounts publication.

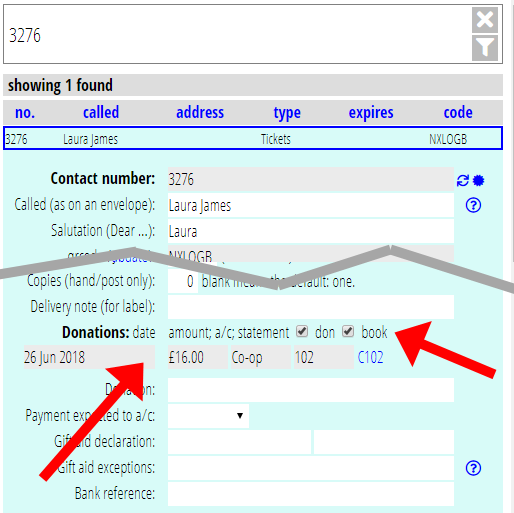

Because the booking is attributed to a membership record, the payment will also show up in their payment history:

Just as donations can be excluded from the complete payment history list, there is now a further tick box to include or exclude bookings from the list.

Gift aid claims

The amount concerned will be included in the Gift Aid return for the relevant date, which can be generated in Accounting Info – just like it would be for a donation – if :

- the member or contact has made a Gift Aid declaration,

- there are no date exclusions set for gift aid for that membership, and

- the booking was attributed with Gift Aid when reconciled.

Gift Aid is not normally allowable for a purchase for a service or item, but in some cases a small voluntary surcharge (a higher-priced ticket) can make the whole value allowable. You would need to study HMRC’s rules carefully if doing this.

Publishing accounts

As well as including the attribution in the statements exported when accounts are published, if Cameo is connected to an accounting system automatically and has been given an account code for bookings (aka cost code or cost-centre code), the bookings are also sent to it directly. Therefore, when the statement line is reconciled in the accounts system, there is automatically something to reconcile it to and bookings can be collected together under one accounting heading. If further attribution is required, or each event is separately accounted for, this can be managed manually from the information provided with the transaction.

Currently this only applies to Xero, but other accounting systems with an API could also be included, in principle.