Cameo’s booking form now has an option to ask for a donation in addition to the ticket cost. You can also ask whether the donation qualifies for gift aid and obtain a gift aid declaration.

Contents

Donation

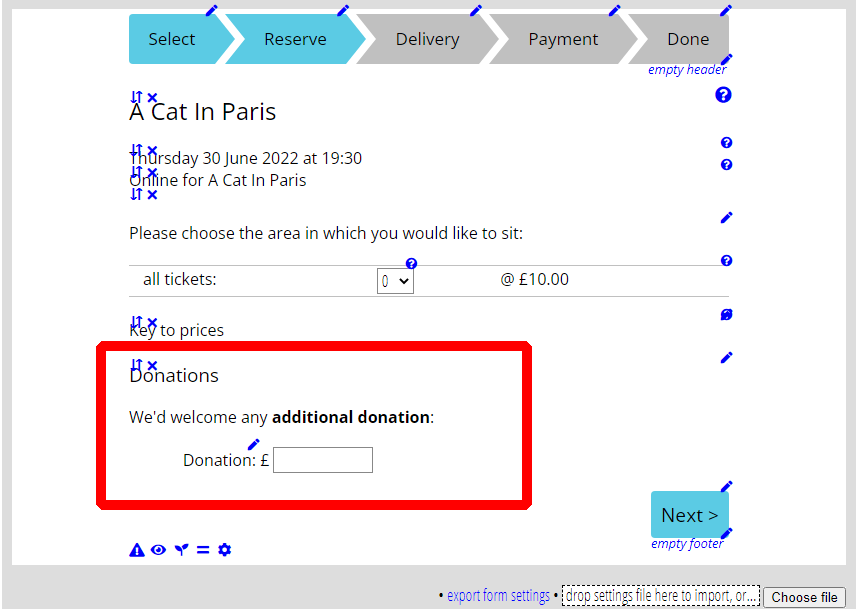

Ticket purchasers may be willing to top up the amount with a donation. Therefore, the booking form can now ask for such a donation. This appears in the step where they book their tickets (Fig 1). [Before March 2022, this was on the following step, but was changed to allow donations to be solicited for otherwise free events].

As it is a form option, you can:

- choose whether to include it or not,

- choose where in that section to position it, and

- customise the wording, both of introductory text (for example, justifying why making a donation would be helpful) and the caption adjacent to the box for the amount.

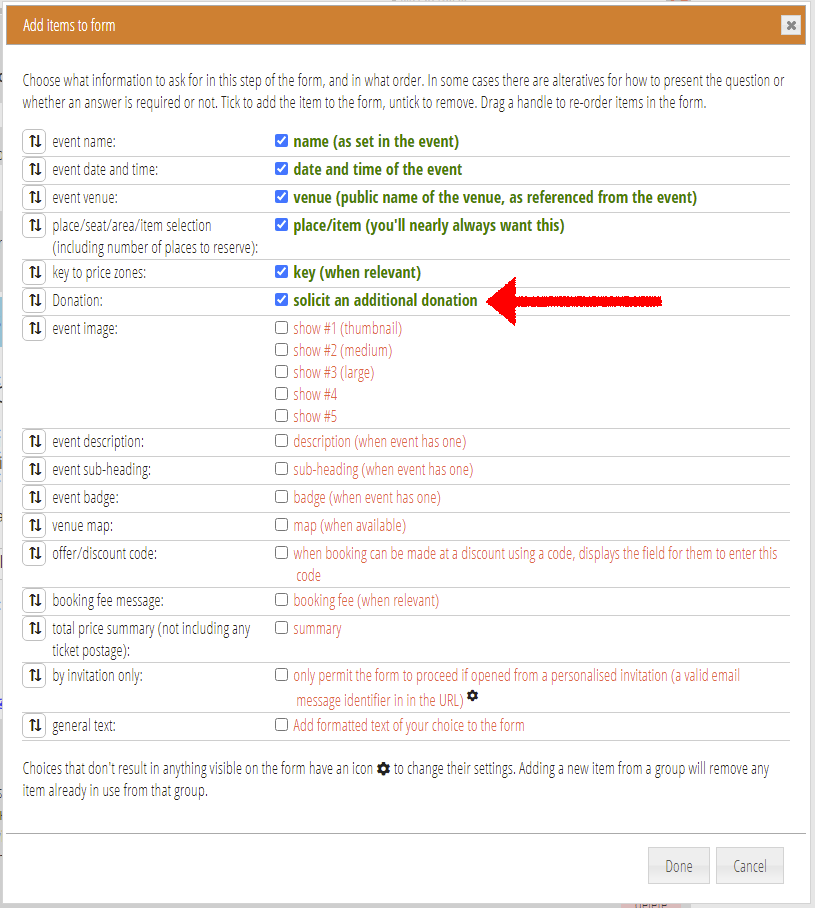

Turn it on in the options for that step, in the same way as any other option (Fig 2).

When you use the payment summary option for the booking form, that now changes to show the donation separately if they make one. This is just like the join and renewal forms in this respect. You independently adjust the wording of each. (We advise stressing additional donation, as our experience shows occasionally people fill in the total amount in the box).

Knock-on changes

- Donations also appear in the amount paid column in the list of bookings in Reservations, bookings and attendance

- Ticket and receipt templates now have two additional substitutions available to them. Also, when you make proforma templates in the event definition it includes them, so they see a donation and thank-you.

{ticket: donation}{if: ticket donation}– only include the following if there was a donation; for example:{if: ticket donation}Donation: {ticket: donation} (thank you)

- If the booking creates a new contact, it records the donation in that membership record.

- When reconciling payments, Cameo recognises a statement transaction as a booking from the reference. It splits the attribution, separately assigning the donation portion as a donation.

- Forthcoming accounting functions will automatically attribute the donation part of the payment to a different account heading from the payment for tickets.

Gift Aid

For registered UK charities (only), donations can attract gift aid tax refunds from taxpayers. Therefore, when someone enters a donation amount, Cameo displays the option to make a gift aid tax declaration in the payment step (like other forms that involve payments). You can only reclaim tax on the donation part of the total payment, not the event booking.

We only show the gift aid part of the form when:

- you have turned on both the donations (Fig 2) and gift aid option in the options for those steps

- the visitor offers a donation by entering an amount in the donation box

- when a visitor accesses the form via a personalised link (so we know who they are in advance of this step), only when they do not already have a gift aid declaration in place.

When the form is not personalised, it would be technically possible to check whether a membership record matches the email address and already has a gift aid declaration, so not offer it again. However, this would cause a leak of personal information: it would allow anyone knowing someone else’s email address to determine whether they have made a gift aid declaration (and therefore possibly to guess their tax status).