Cameo’s new trading → receipts and expenses claims section provides for:

- uploading and storing receipts

- attaching them to associated transactions

- submitting an expenses claim

When making a purchase, whether online or in person, the vendor usually gives you a receipt. To justify such purchases as expenses, you need to keep the receipt.

As part of its new accounting functions, Cameo now offers the means to do that. When you later come to reconcile the transaction with an expense account, you can also easily attach the receipt to the transaction or expenses claim.

Contents

Receipts vs incoming invoices

A receipt records money already paid. Sometimes the vendor provides an invoice recorded as paid rather than a receipt. From your point of view, this amounts to the same thing, a business expense. All you need is the receipt, as evidence.

However, if you have a credit account with a supplier, then their invoice does not represent an expense, at least initially. It is a liability until paid. Even if you did not issue a purchase order to request the original purchase, you should make one for a credit invoice and attach the paperwork to it, rather than just storing it as a receipt. Then it properly represents the transaction that took place.

Collecting receipts

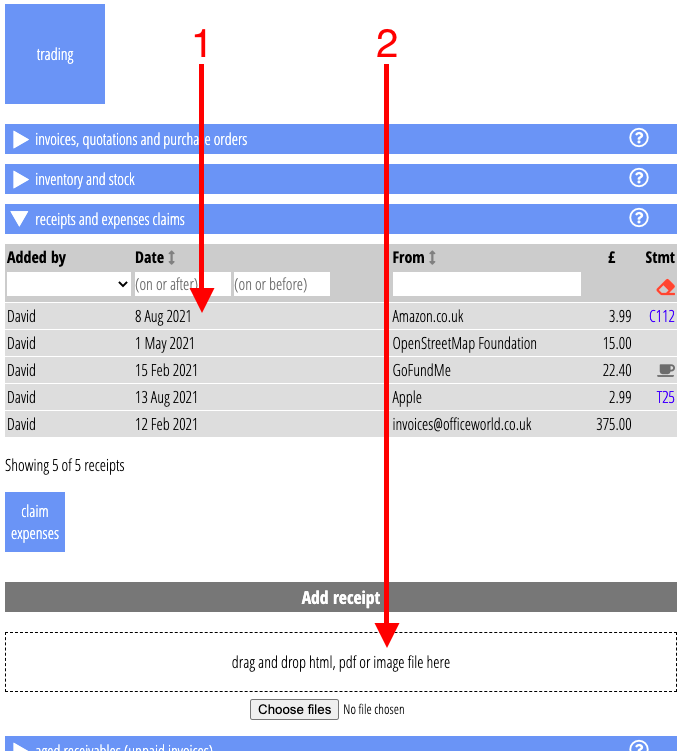

- Upload a receipt manually, in the receipts and expenses claims section (as a HTML document, a PDF file or an image; Fig 1: 2). Drag the file onto the drop target provided, or choose using File Explorer (Finder on Mac).

- Scan (and OCR) direct from a scanner app (Scanner Pro recommended). Save the scan to the Receipts folder once you have set up the scanner link to Cameo.

- Forward an emailed receipt to the Cameo’s inbox (see profile → incoming email). The email address will usually include

receiptorreceipts. For examplereceipts@to.cameo.example.com. Cameo also stores the email subject line as the receipt description. So, if you are sending a personal expense to claim back, just change the subject line to give its purpose.

Most likely these days you will receive a receipt by email so forwarding is often the most convenient method.

For HTML and PDF receipts (which contain text, not just an image), Cameo tries to extract from the attachment:

- sender name,

- date of receipt, and

- total amount.

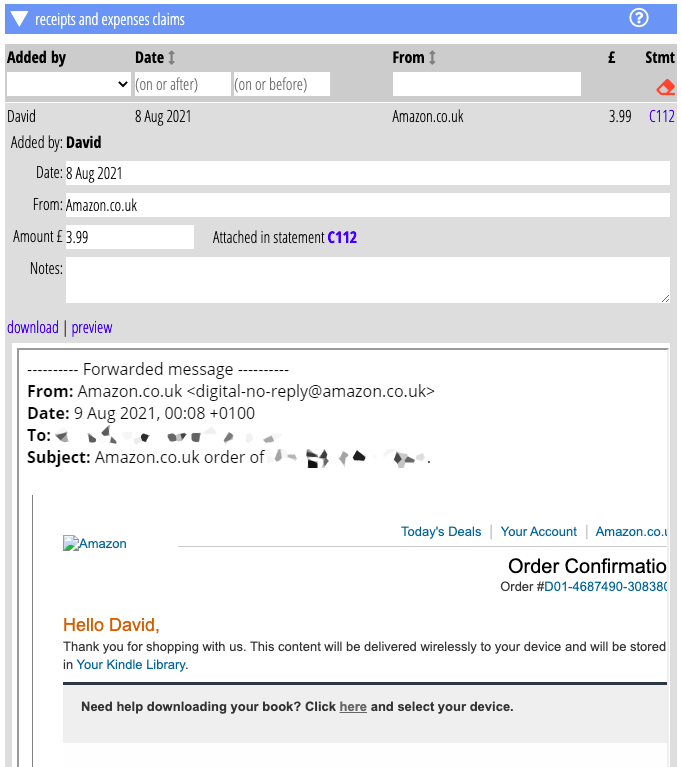

However, if Cameo cannot make sense of it (perhaps it is an image, or is missing the prompts Cameo uses to extract appropriate text), add the details manually once you have stored the receipt (Fig 2).

Attaching a receipt

For receipts that are direct expenses, for example paid on a corporate card, you can attach the receipt to the transaction on the card statement.

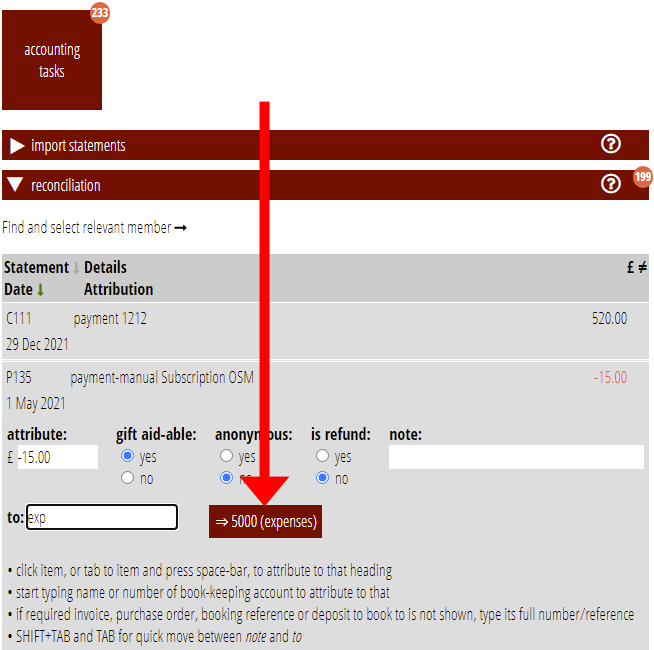

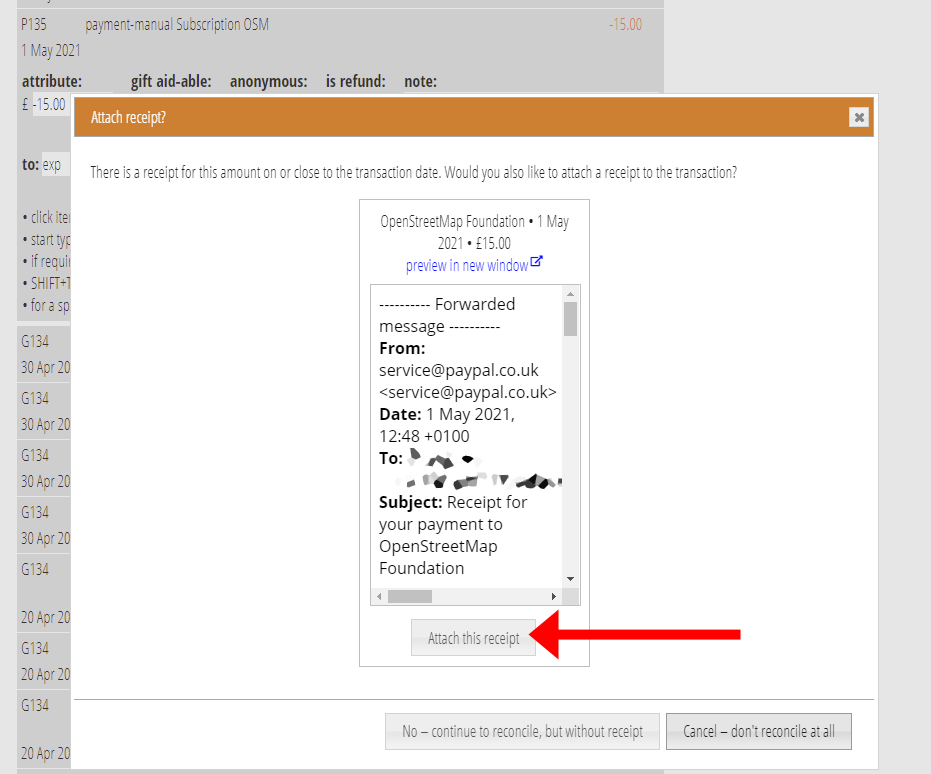

During reconciliation in accounting tasks → reconciliation Cameo checks whether transactions attributed to an expense account (Fig 3) have a receipt for the same amount, on the same day (or up to five days after the receipt date: sometimes banks do not debit the same day). If it finds a receipt (or maybe more than one candidate), it offers it (them) to you to optionally attach to the transaction (Fig 4).

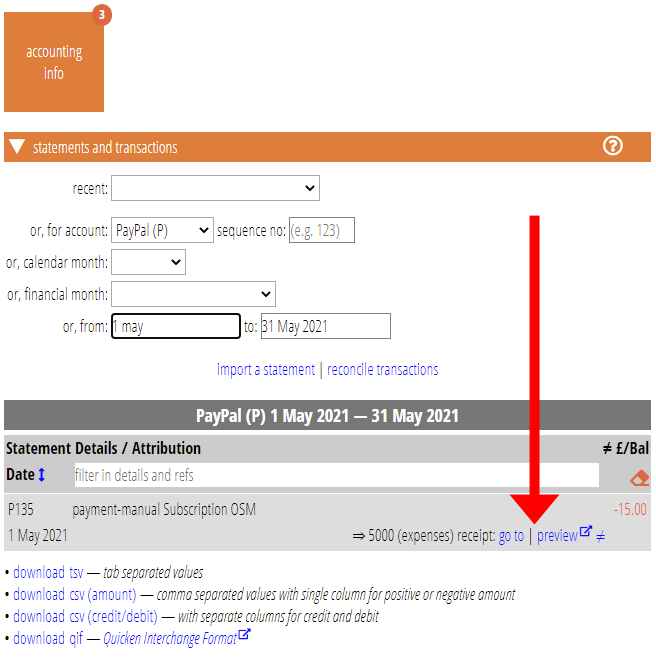

If you accept, then the statement (in accounting info → statements and transactions) shows it has a receipt attached and offers a link to preview or go to the receipt (Fig 5).

Cameo continues just to store receipts even if you don’t attach them.

When you do attach a receipt to a transaction, but later unreconcile it, Cameo removes the link to the receipt as well.

Typical workflow example

- You buy a toner cartridge from Amazon, using your credit card

- Amazon sends you a purchase receipt (or already paid invoice) by email

- You forward that email to the recipts email address for Cameo

- The receipt appears among the Purchase Receipts in trading → purchase receipts

- Some time later, your credit card statement is available and you upload it to Cameo

- The statement shows the purchase, dated on or shortly after the date of your receipt for it

- Later still, you reconcile these transactions, in accounting tasks → reconciliation, attributing the toner cartridge purchase to your office expenses account from your chart of accounts

- When you do so, Cameo spots that there is a receipt for the same amount on the day after the transaction date

- Cameo offers you the opportunity to attach that receipt to the transaction you are reconciling

- If you accept, a link to the receipt appears against that transaction on the credit card statement in accounting info → statements and transactions

Making an expenses claim

Where you intend to claim back personal expenses from receipts, you can also use accumulated receipts to make the expenses claim.

Click the claim expenses button underneath the list of receipts. Cameo then offers you a list of receipts that:

- you (the logged in Cameo user) have submitted

- haven’t already been claimed

- haven’t been linked to a transaction

- include an amount

You have the opportunity to remove any of these you don’t want to submit before actually submitting.

When you do submit, Cameo effectively treats your claim as an incoming invoice. Cameo:

- emails a summary to the address you provide, which defaults to the treasurer email in orgnaisation settings, if any. You receive a copy.

- creates a purchase order with copies of the receipts attached, each one forming a line item.

- displays a coffee-cup icon in the list of receipts to show it has formed part of a claim (Fig 1)

This means:

- Cameo applies the usual reminders, approval conventions and timescales

- reconciliation of the overall payment has something to reconcile to, and with one click (there is no need to do a split transaction to account for the expenses separately)

- you or the recipient can attribute each expense to a (possibly different) account in the purchase order (for example, you may need to book sustenance expenses to a different code from say office equipment purchased on the organisation’s behalf).