- If your organisation doesn’t or can’t accept Gift Aid, we can now turn it off so it does not appear anywhere

- Gift Aid declaration wording is centralised and new substitutions let you include it in templates and forms

- Declarations now include the time as well as date, and their source

- You can now scan a paper gift aid declaration specifically rather than as a general attachment

- Gift Aid claims downloaded for submission to HMRC are now also saved as attachments

Contents

Background

Gift Aid is a method where charities registered with the Charity Commission in the UK (and a few other organisations) can reclaim tax paid by taxpayers on donations.

The scheme works like this:

- A donor completes a declaration (provided and retained by the charity) about their tax status; they are responsible for ensuring they pay enough tax to cover all these commitments

- The charity makes a claim to HMRC (usually annually or quarterly) for the relevant donations on record

HMRC requires you to keep an audit trail of Gift Aid declarations. This means keeping an accessible copy of any declaration in case they audit your claim:

- email making a declaration

- a scan of any paper form

- a record of acceptance from any online form

You can already do all of these. The changes here just make this a bit easier, clearer, more consistent and centralised.

You previously set the wording of your declaration independently in each form that needed it. We now centralise this. These form types can include a Gift Aid declaration:

- giftaid (which exists solely for making a declaration)

- join

- renew

- booking (when they make an additional donation)

- payment (typically when used as a donations form)

Declaration wording

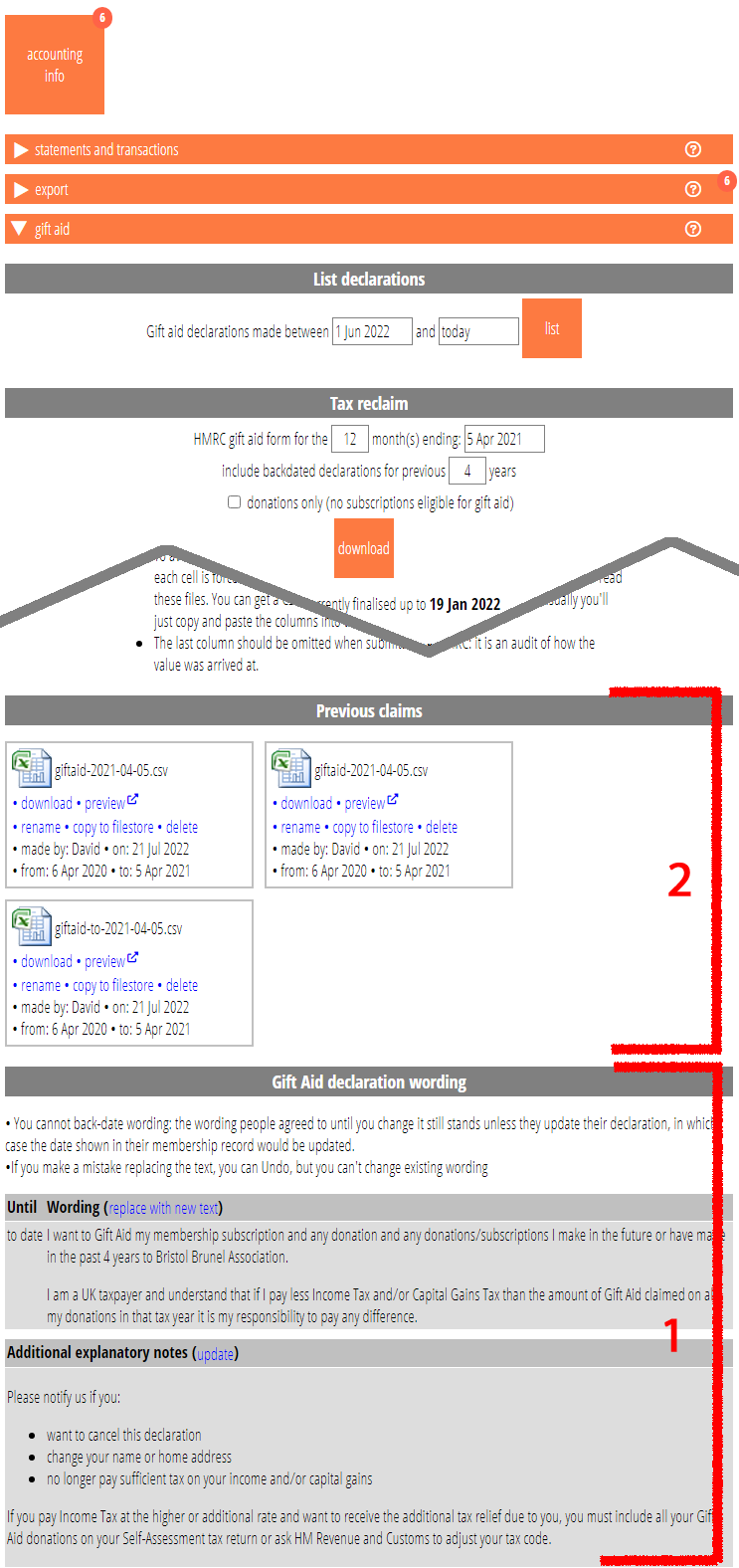

Give the wording of your Gift Aid declarations in accounting info → gift aid (Fig 1: 1).

If you update the declaration itself, Cameo dates and retains the older one, so declarations already made link to the old text.

In addition you can provide some explanatory notes, which are not part of the formal agreement. Cameo does not version these.

substitutions soliciting gift aid

Insert wording and explanatory text provided like this into emails using two new substitutions, respectively:

{insert: gift aid declaration}{insert: gift aid notes}

You might use these in an email soliciting Gift Aid for donations. You could use the existing condition {if: not gift aid} beforehand to only do that when the recipient does not already have a declaration in place.

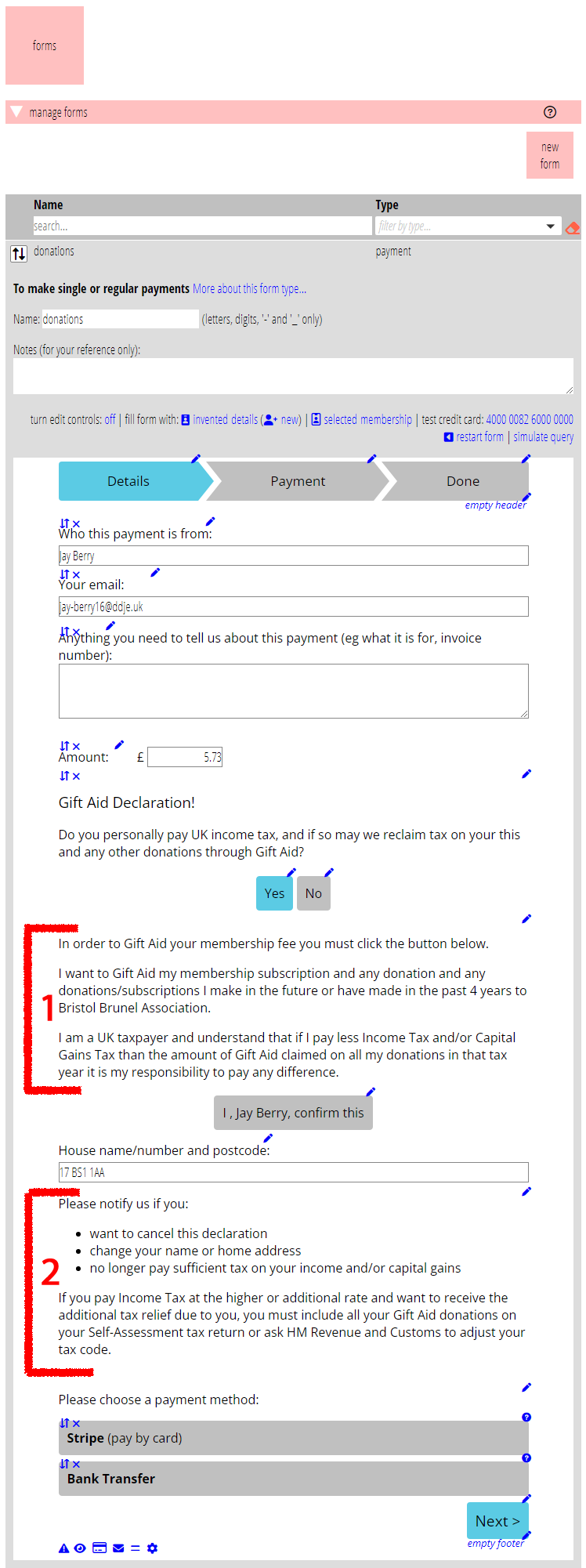

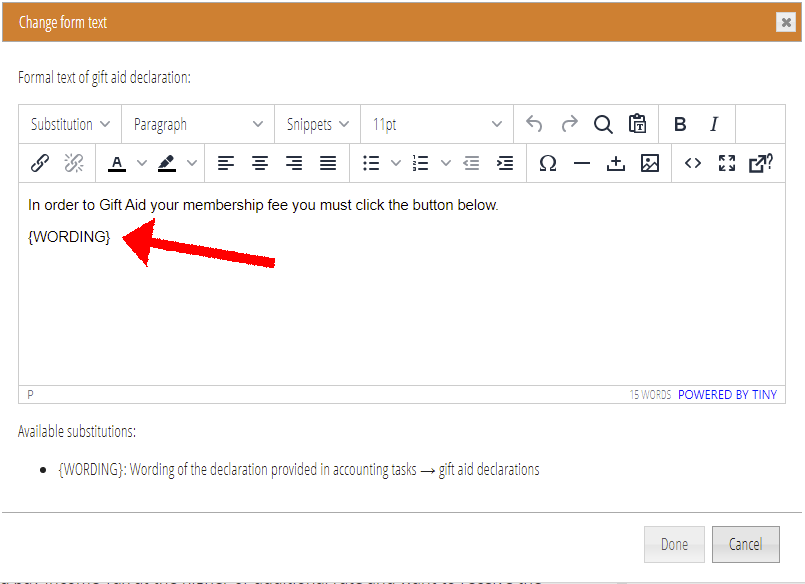

Similarly when you offer Gift Aid in a form, include in the respective text sections of the form the substitutions

{WORDING}(before the button to agree; Fig 2: 1, Fig 3){NOTES}(after the button to agree; Fig 2: 2)

Indeed, this may be the only content of those parts, though you might also include a heading and maybe introduction before the declaration wording.

substitution confirming gift aid

When you send email which confirms people’s details, you may want to include whether they have made a Gift Aid declaration or not. The email template used when someone finishes completing the join form is an obvious example. However, things like renewal reminders might include their details just to prompt them to make changes if necessary.

The substitution to do this is:

{show: gift aid}

Previously the mail merge would substitute yes or no appropriately (with but not for tax year(s) starting ... if there are exceptions). Now, however, instead of yes it inserts

yes (on date, person declared: wording)

where the wording is the one that applies on the date of their declaration. This reminds them of their commitment made to HMRC.

Source

A new field shown in the membership record, the gift aid source, records how a member made a Gift Aid declaration.

People will make almost all declarations electronically these days. When they:

- fill in a Cameo form online, the field will automatically say which form it originated from.

- send you an email making the declaration and you forward it to Cameo’s gift aid email address, we’ll record it’s source as email (which we attach to their record).

- send a paper form you can scan it direct to Cameo using the new Gift aid declarations folder in the scanner. We’ll attach the scan and also record it as a Gift Aid declaration including source as a scan.

However, if you do need to manually upload the evidence in member info → attachments, you can complete the source field manually as well.

Claims

Generate Gift Aid claims to HMRC in accounting info → gift aid as before.

However, when you do this, we now save the generated file and display it as an attachment just below (Fig 1: 2), along with who made it and the relevant dates. Additionally, we include any anomalies picked up during claim generation at the bottom of the file. This also means you can use the same facilities as other attachments, in particular to preview the spreadsheet in your browser, and to re-download it without re-generating it.

While you still need to edit the spreadsheet before submission, importantly, we keep the column which shows how each we arrived at each row, for any auditing. Hopefully you kept these files previously anyway, but now we centralise this. There is no upload, but if you have older files, let us know and we will include them here for you.