Gift Aid declarations now appear just as text, rather than editable fields, in the membership record. To add or delete them, click the respective button alongside.

Contents

Background

Gift Aid is a method where charities registered with the Charity Commission in the UK can reclaim tax paid by taxpayers on donations. The donor makes a formal declaration to allow this.

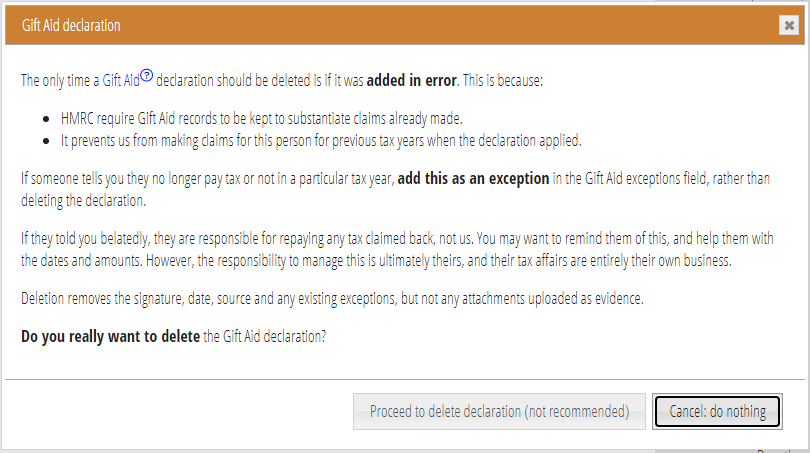

HMRC requires charities to keep records of declarations to substantiate past claims. Therefore you must not delete declarations except in quite unusual circumstances, for example if you accidentally applied the declaration to the wrong membership.

Deleting a declaration also prevents the charity from making a previously valid claim for that person.

It became apparent that it was too easy to delete a declaration without realising the legal consequences. Therefore, the presentation of Gift Aid declarations now makes the consequences of deletion clearer.

The correct procedure in these circumstances is to make an exception for all future years. That is unchanged.

Adding a new declaration

Members make most Gift Aid declarations by themselves in forms, for example when joining. Sometimes, though, they email a declaration, or even complete a paper form.

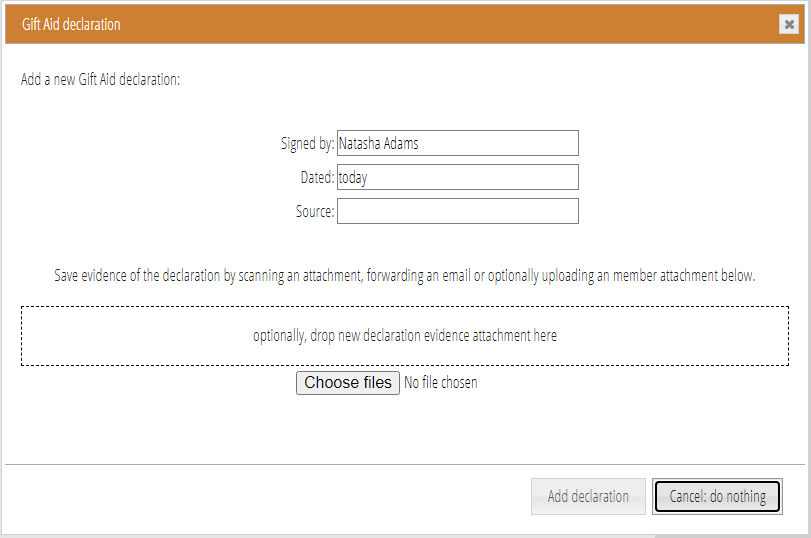

When that happens, you need to add the declaration manually. Store the evidence as an attachment, by forwarding any email, scanning the paper form, or uploading it.

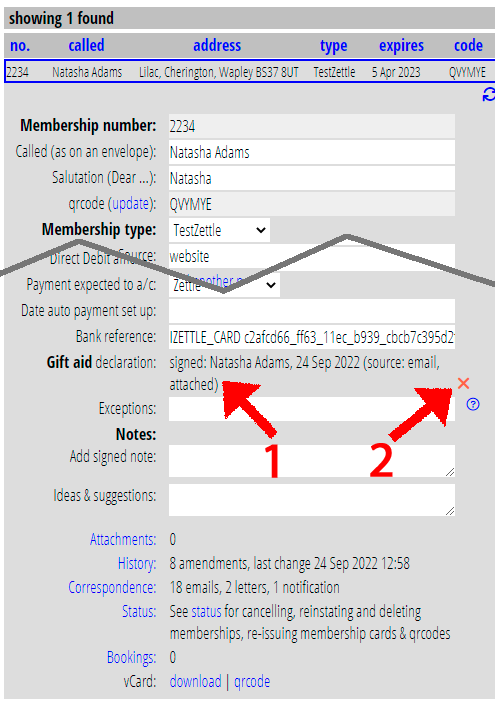

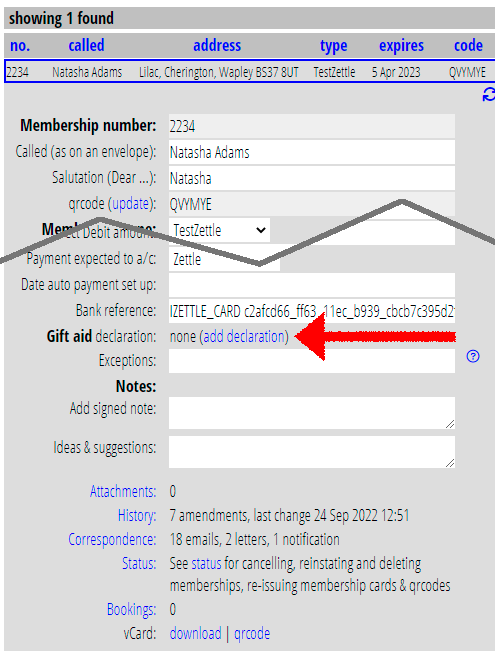

You also need to add the name of the signatory, the date of signing, and a note of the source (such as paper form). Instead of just filling in those blank fields, now click add declaration (Fig 1) and provide all three in the box that pops up (Fig 2). You can also upload attachments here as evidence if you need to.

Delete a declaration

When a declaration already exists, you will see the signatory, data and source, but you cannot edit them (Fig 3:1). To delete the declaration, click the delete button (×) alongside (Fig 3: 2).

That pops up a box offering to do the deletion, but explains in detail why this is usually not a good idea (Fig 4).