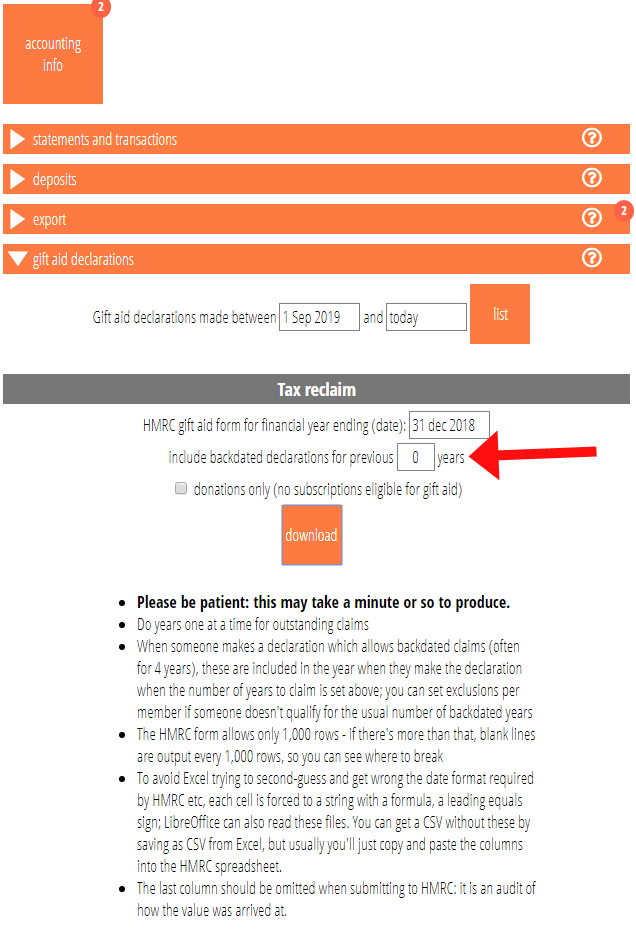

Tax reclaim in accounting info → gift aid can now include backdated claims for a number of years that you choose.

This corrects an oversight in the previous claims mechanism. Gift Aid declarations can include the option to reclaim tax on donations made in previous (up to four) claim years as well as the year in which the declaration is made.

So if you put “4” in the box, anyone whose declaration is made in the year for which you are generating the claim (as given in the first box) will include any eligible amounts paid for that year and the previous four.

For example, if you are claiming for the year ending 31 December 2018, then for most people the claim will only include payments made between 1 January 2018 and 31 December 2018. However for someone who makes a gift aid declaration on 1 November 2018 which includes backdating by 4 years, then any eligible payments made by them between 1 January 2014 and 31 December 2018 will be included. The following year, they will not as this only applies to the year in which the declaration is made.

If someone tells you they have a limited number of eligible previous tax years, you can include these in their record as gift aid exceptions as for any other years. Note that exceptions are for tax years, so in anyone claim year some payments may be included and others excluded according to the tax year in which they fell.

As it takes some time to produce a gift aid claim, I have take the opportunity to add a progress bar as well.