The Gift Aid report for reclaiming tax, generated from accounting info → gift aid, now lets you request an arbitrary number of months-worth of donations. This means you can claim quarterly, for example.

Contents

Background

Previously, gift-aid reporting only allowed you to get a whole year of donations at once for submission to HMRC.

Updated controls

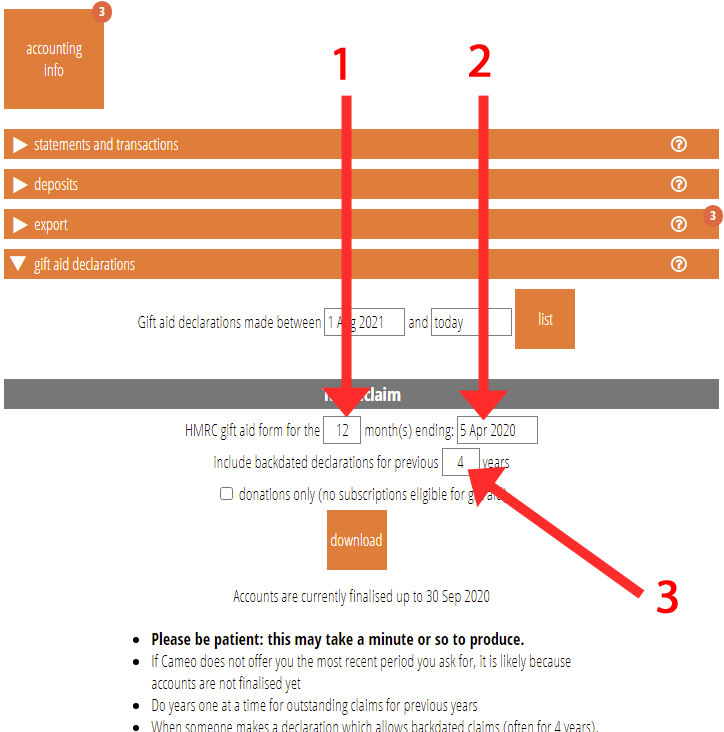

The gift aid section now provides a default: your most recent full financial year (that has finalised accounts). It also sets the default backdating to 4 years, HMRC’s normal allowance (Fig 1: 3), instead of zero.

When you change the number of months from 12 (Fig 1: 1), Cameo also adjusts the end date for the report (Fig 1: 2). It inserts the most recent period of that number of months with finalised accounts, aligned with your financial year.

For example, say your financial year ends on 30 April. When you ask for a 3-month report any time between 1 August and 31 October, Cameo will offer the quarter ending 31 July. (That is the first quarter of your financial year, subject to finalised accounts available to 31 July). From 1 November it will offer the second quarter, ending 31 October, and so on.

You can change the default end date if you need to. That allows you to deviate from alignment with your financial year if necessary.

Other changes

- You now get a warning if you try to produce a report for a period for which not all accounts have been finalised

- The name of the downloaded file and also the grand total line of the report include the start and end dates of the period covered by the report. This makes it easier to generate the next one.