Book-keeping income accounts now have an additional option, membership donations. This helps attribute membership payments to the correct book-keeping account, when reconciled manually and which include a donation.

If you do this, you may want to make an adjustment to the income type of one of them. However, even if you don’t, Cameo will now ask you rather than potentially choosing the wrong account.

Contents

Background

When you use book-keeping accounts to categorise payments, it is often useful to maintain several for donations income. You can keep donations made for different reasons separate, and report on them separately (as well as in aggregate). One source of donations arises from people paying an additional amount with their membership fee.

Often, join and renewal forms make attributions for you automatically. Where these payments include a donation, you include a book-keeping-account tag in the form. That identifies which account it should attribute the donation to. This hasn’t changed.

However, where a donation is include in an automated renewal you’ll need to manually reconcile it. For example, they may include a donation in a standing order on each renewal. You could make a split transaction and assign each part to the correct book-keeping account. But instead, you can just attribute it to membership. That splits the payment up for you. It first attributes any membership fee, then any donation, and if anything remains, then to overpayment. The donation amount comes from the donation field in the membership record. That’s because it often stays the same from year to year. In any case, you can adjust it first if necessary.

It became apparent, though, that in this case, the attribution did not know which book-keeping account (designated to receive donations) it should attribute the donation part to. In fact, it chose the first one it found, which is effectively random. It is this anomaly that this change addresses.

Membership donations income type

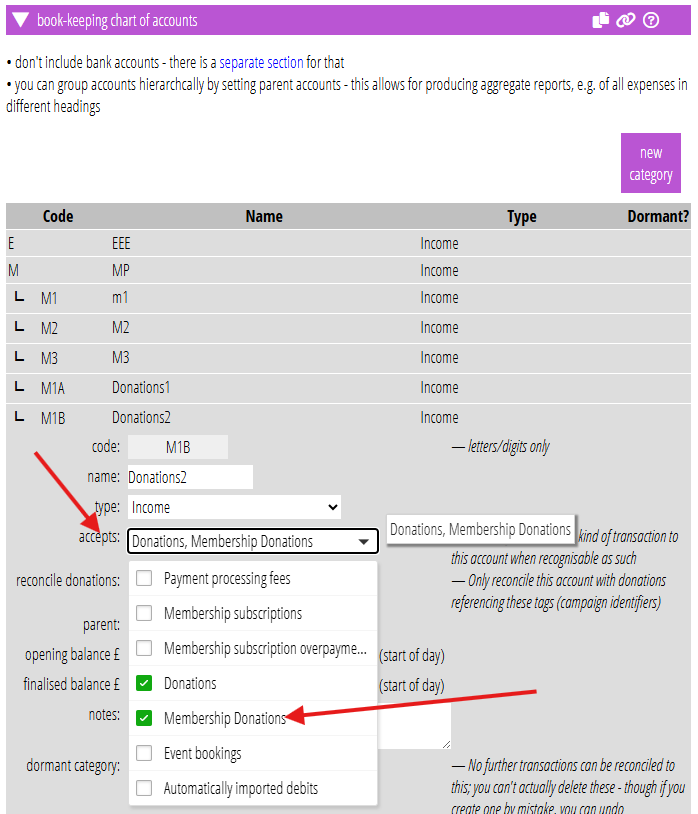

Now, you can select both Donations and the more-specific Membership Donations as the kind of income a book-keeping account accepts (Fig 1). Membership donations only affects the account selection when you manually reconcile a complete membership payment. You’ll almost certainly still want Donations as well. That’s because attributions arrived at in other ways may still look for Donations. For example: if you manually split the payment and attribute the donation separately.

There should only be one Membership Donations account, so the behaviour on attribution is no longer ambiguous. Donations, separately, means you can still have have multiple donations accounts. If you don’t identify any such account, we attribute as before, so we maintain backward compatibility. This is especially the case when there is only one such account. If there is more than one (and the attribution was effectively random) we deal with it by asking you (see below). But you can avoid the question each time by setting an appropriate Membership Donations account.

Multiple account choice

When any attribution to a book-keeping account is ambiguous, Cameo now asks for clarification. This applies whether donation or otherwise, though donations are the most common case. If this arises, you see a box pop up. This lets you select the relevant account (or abandon the reconciliation while you investigate). Just click the button for the book-keeping account you want to attribute to.